Building a new restaurant, expanding or selling an existing restaurant, or admitting a new partner require an accurate valuation so that you will know how to structure the terms of a deal. Whether you are a single-unit or multi-unit concept, the value of your restaurant is mostly driven by profitability and cash flow at the unit level (meaning your store-level profitability must be positive). Inexperienced restaurateurs tend to overvalue their restaurant brand and concept when they’re not profitable; then they face a wake-up call when it’s time to raise money or sell. In this two-part series, we will show you (1) how to value and assess the viability of a new restaurant project and (2) how to value an existing restaurant so that you can strategically raise money for a new location, admit new partners, expand and improve your current operation, or sell.

Valuing a New Restaurant Project

Assessing a Restaurant Project in a Leased Space

The simplest way to assess the viability of a restaurant investment is by using the sales-to-investment ratio. This ratio divides the expected annual sales by the total startup costs. In this context, startup costs include all costs incurred before opening day, including buildout, equipment, furniture, deposits, inventory, and other pre-opening expenses such as supplies, salaries, accounting, legal fees, architects, etc. We also recommend adding a 3-6 month working capital reserve for operating losses to startup costs. You can subtract tenant improvement allowances from your startup costs for purposes of this calculation.

It’s extremely important to be pragmatic and as accurate as possible when it comes to projecting sales because this will dictate the success of your restaurant’s sale or capital raise. The projected sales will determine whether a location is appropriate and your restaurant is a sound investment. There are a variety of tools available on RestaurantOwner.com that allow you to project sales accurately.

Sales to Investment Ratio = Sales / Total Startup Costs

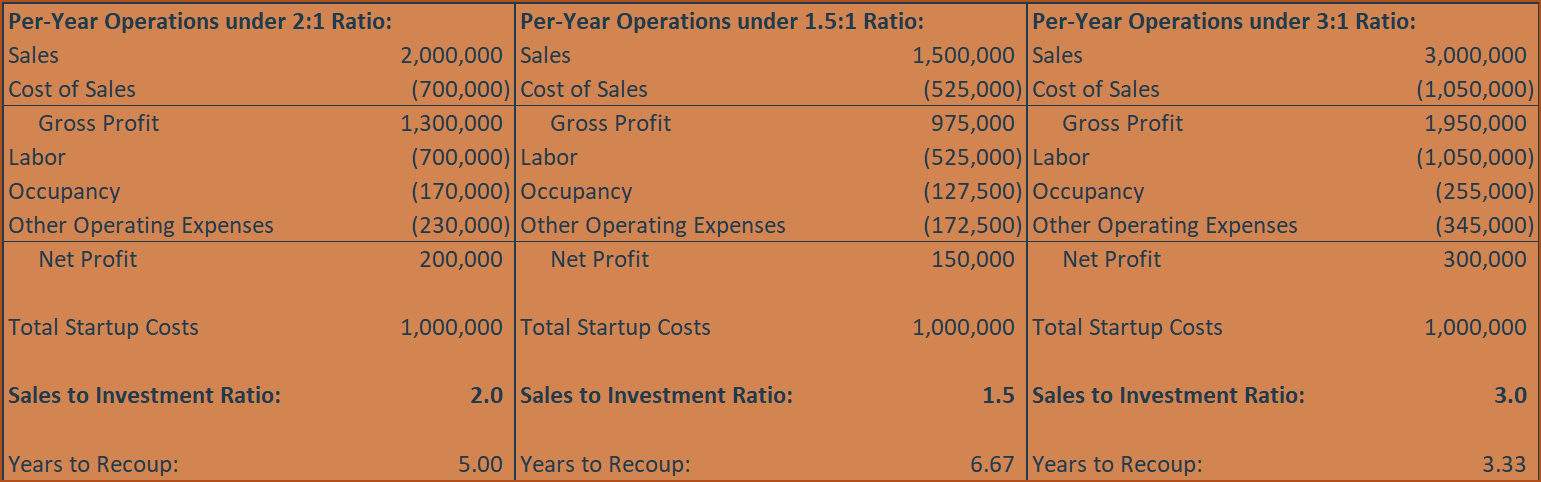

The minimum Sales to Investment Ratio is 2:1. In other words, a restaurant should expect to generate at least $2 of annual revenue for every $1 of startup costs. For example, if your startup costs total $1m, then you should expect to generate at least $2m in sales each year from opening day. This assumes your unit economics (operational performance per store, food, labor, operating expenses, occupancy, etc.), especially occupancy costs, are at least on par with industry averages. Check out our article on the ideal occupancy cost and percentage rent to ensure occupancy costs as a percentage of projected sales are valid before signing a lease.

Assuming the unit economics are on point, an average restaurant would net around $200k profit on $2m in sales, and it would take a little over five years for investors to recoup their investment. A high-performing restaurant could recoup the investment in as little as 2-2.5 years if they consistently exceed industry profitability averages. Anything under a 2:1 ratio is too low of a sales-to-investment ratio for a risky endeavor such as a restaurant. As I mentioned above, this ratio is irrelevant if the occupancy costs for the space are too high; therefore, it’s important to understand the occupancy cost as a percentage of projected sales before using it to assess the feasibility of a restaurant project.

The industry average for sales to investment is 1.5:1, but that doesn’t mean it’s right or should be your goal. At a 1.5:1 sales-to-investment ratio, it would take the average investor 6+ years to recoup their investment. For example, if the total startup costs are $1m, and the restaurant generates $1.5m of sales and operates smoothly so that the EBITDA is around $150k, it would take 6.67 years ($1m startup costs divided by $150k projected profit) to recoup their investment. After 6.67 years, they would finally see an ROI. Therefore, use 2:1 as your sales-to-investment ratio break-even point, ideally aiming for 3:1. Even national franchises and chains often aim for 3:1.

Assessing a Restaurant Project in a Purchased Space

If the land and building are being purchased for the new restaurant space, then either (1) the land and building should be included in the startup costs using the ratio above, or (2) the land and building should be assessed separately as a rental property investment. If the land and building are included in the startup costs, then the expected sales-to-investment ratio can be between 1-1.5, depending on a variety of factors that are outside the scope of this article.

Conclusion

When assessing the viability of a restaurant venture, focus on using the sales-to-investment ratio. Although this ratio was designed to assess the viability of a new location, it can also be used to assess the sales of an existing restaurant relative to its startup costs. Part 2 of this article series will show you how to value an existing restaurant and how these valuations are determined by thinking like an investor. Have questions about valuing your restaurant? Schedule a call with us!