Gone are the days when you could freely generate a loss for a restaurant using bonus depreciation and then offset your other sources of income using those losses. The losses you can claim from your restaurant or bar against your other sources of taxable income, such as wages or investment income, are now limited. These loss limitation rules were introduced as part of the Tax Cuts and Jobs Act (TCJA) of 2017 but were postponed due to the coronavirus pandemic. They are now enacted and will apply from 2021 through 2029, significantly impacting tax planning for your restaurant or bar. Let’s walk you through the mechanics of the excess business loss rules and net operating loss (NOL) limitation so you can plan strategically.

Excess Business Losses (EBL)

The losses you can claim from your restaurant or bar against your other sources of taxable income, such as wages or investment income, are now limited to $289,000 for single filers and $578,000 for joint filers (for 2024, the inflation-adjusted amount is $305,000 for single filers and $610,000 for joint returns). Any disallowed loss is carried over and claimed against future taxable income, but only up to 80% of taxable income annually, as discussed in the NOL limitation section. For example, assume Jane owns six restaurants, and in 2024, three of those restaurants profit $100,000 each, but the other three lose $300,000 each, the net loss for all six restaurants would be $600,000 (($100,000 x 3) – ($300,000 x 3)). Jane also earns $400,000 in wages from a management company that services her restaurants. Jane can only apply $305,000 of the net losses from her restaurants against her $400,000 wage income. Before 2021, she could have applied the entire loss to zero out her taxable income. The remaining $95,000 of wage income gets taxed at ordinary income tax rates, and the remaining loss of $295,000 gets carried over to future years as an NOL. These excess business loss rules apply after the passive activity loss and at-risk rules are applied, but passive activity loss and at-risk rules are beyond the scope of this article.

Net Operating Loss (NOL) Limitation

An NOL is the excess of allowable tax deductions over gross income, with certain modifications not discussed in this article. For calculating the NOL, income and deductions from separate businesses are aggregated, and items that are excludable from gross income are generally excluded. NOLs arising in 2018, 2019, and 2020 may be carried back five years and forward indefinitely. NOLs arising after 2020 are carried forward indefinitely until used up. The most impactful change with NOLs resulting from the TCJA is that an NOL arising after 2017 can only offset 80% of taxable income in a carryback or carryforward year. NOLs are used in the order they arise, so all pre-2018 NOLs can be used up and applied to 100% of taxable income before the post-2017 NOLs start being utilized, subject to the new 80% limitation.

Now that you understand how NOLs work generally, let’s see this in action using Jane’s example from above. Jane has a 2024 NOL of $295,000 carried over to 2025. Assume her wages in 2025 are $200,000, and the taxable profit from all her restaurants is $100,000, for a total taxable income of $300,000. Jane can offset only up to 80% of her taxable income with the previous year’s NOL, or $240,000 ($300,000 x .80). The remaining $60,000 of taxable income is taxed as usual, and the unused NOL of $55,000 ($295,000-$240,000) carries forward until used up in future years.

Tax Planning for Restaurants

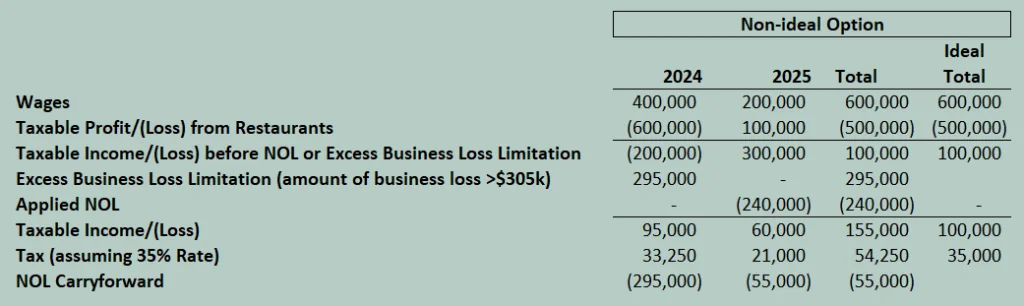

We have summarized the results of Jane’s example in the table below. This doesn’t consider the qualified business income deduction or self-employment taxes for simplicity, but it summarizes the impacts of the NOL and EBL limitations. As you can see, these limitations can have devastating consequences for restaurateurs if the proper planning is not in place. Jane only made $100k between 2024 and 2025 but paid $54,250 in income taxes because she was essentially taxed on $155,000 due to poor tax planning. Ideally, she should have only been taxed on $100,000.

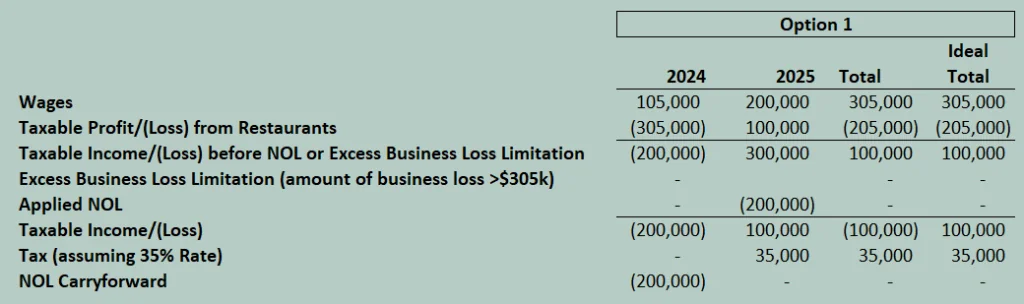

So what can you do to plan appropriately? It depends on the choices that are on the table at the time, but here are a few things Jane could have done. First, she could have lowered the management fee that her management company charges her restaurants to reduce the overall losses of the restaurants to $305,000 (the threshold for EBL in 2024). This assumes the management company is a break-even operation after paying the owner’s wages. Here is the impact that would have:

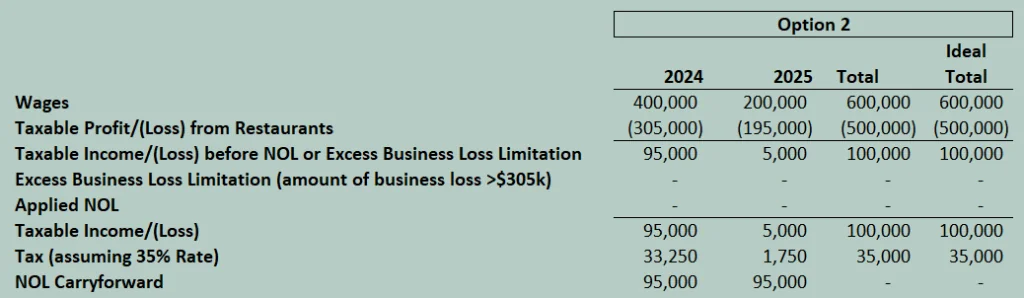

This would save Jane almost $20k in income taxes over 2 years. Alternatively, she could delay certain transactions, causing the restaurant’s losses to reach the ideal business loss threshold of $305,000. For example, she could delay placing certain assets in service to 2025 or select sec 179 on certain assets placed in service instead of bonus depreciation to claim the business losses in future years. You can read more about strategic planning between bonus depreciation and sec 179 in this article.

As you can see in Option 2, Jane was able to shift the business losses from 2024 to 2025 and ended up paying tax on $100,000 instead of $155,000, as shown in the non-ideal option.

Next Steps

Tax planning for the NOL and EBL limitations requires your tax accountant to participate in your business decisions proactively. Waiting until after the year ends, or even quarterly, to have conversations with your tax accountant may not be enough to make the decisions that can mitigate taxes significantly. Your hard-earned dollars shouldn’t go to the IRS when they can be reinvested in growth. At The Fork CPAs, our monthly plans are designed to give you unlimited access and open communication with your accountant so you can have real-time visibility into your restaurant’s financials while strategically planning for taxes. Schedule a call with us to get started!