When paying a DJ, musician, comedian, or other performer in your restaurant, bar, or nightclub, there are a variety of forms you need to request, prepare, and file with the IRS. Sometimes, you may also need to withhold taxes and remit to the IRS. The forms you request from and file on behalf of your performer will depend on whether they are a US resident and whether you’re paying an agency or the performer directly. In this article, we’ll walk you through the nuts and bolts of paying performers and artists in your restaurant, bar, or nightclub so that you have a clear and compliant payment process.

From a tax perspective, you may need to request multiple forms before paying an artist. The forms you request will depend on whether the artist is a US or non-US resident.

US Artist

A US artist is a:

- citizen or resident of the United States;

- partnership or corporation created or organized in the United States; or

- non-citizen or national meeting the green card or substantial presence test.

Forms to Request

If the artist is a US resident, you must request a form W-9 before paying them. A W-9 form provides you with the information (legal name, address, tax ID, etc.) necessary to file a Form 1099 on behalf of the artist at year-end. If the artist is being paid through a US-based agency, you must request a W-9 from the agency because the year-end form 1099 will be issued to the agency, not the artist. The agency is then responsible for filing 1099s on behalf of its artists. A W-9 does not have to be filed with the IRS; it’s for your records only.

Withholding

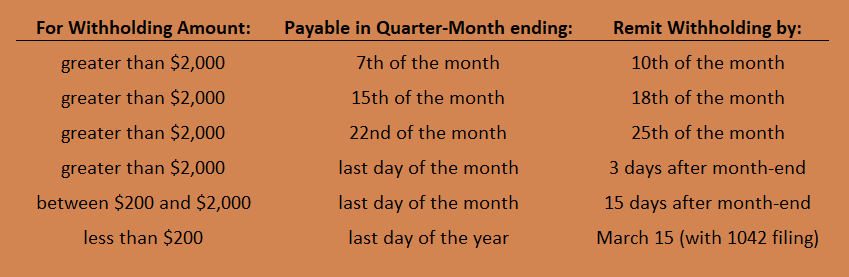

If the artist or agency is unwilling to provide a fully completed W-9, you must withhold 24% of their payment and remit it to the IRS as a backup withholding. The deadline for remitting these withholdings to the IRS depends on the amounts:

Forms to File with the IRS for US Artists Who Didn’t Provide a W-9

If you withheld 24% from a US artist or agency’s payment because they didn’t provide a fully completed W-9, you must file Form 945 by February 12 of the following year to report the payments remitted to the IRS for the year. If you didn’t make all your backup withholding deposits on time or have a backup withholding amount less than $2,500, as shown above, you must file Form 945 by January 31 of the following year.

Forms to File with the IRS for US Artists Who Did Provide a W-9

You must file a Form 1099-NEC with the IRS by January 31 for any US artist or agency paid more than $600 annually in the previous year. You do not need to file this form for any payee structured as a C-corporation or S-corporation for tax purposes. The W-9 will tell you whether the payee is an S-corporation or a C-corporation. The 1099-NEC will show the year’s total payments to that artist or agency. A copy of the 1099-NEC should also be issued to the payee so they can report this income on their tax returns.

Non-US Artist

A non-US artist is an individual who is not considered a US resident under the criteria above. The general rule is that a non-US artist earning compensation for services performed in the US must pay income tax on those earnings. As the payor, you must withhold taxes on their earnings and remit them to the IRS; then, the payee may recover the difference between amounts withheld and owed by filing a US tax return. It’s a similar process to that of a US employee receiving a W-2 and filing their taxes at year-end to claim a refund; the problem is that there aren’t payroll processors that automate this process for you.

Forms to Request

If a non-US artist is being paid directly or through a US-based agent, you must request a form W-8Ben from the artist. If a non-US artist is being paid through a non-US-based agency, you must request a completed W-8IMY form from the agency.

The purpose of these W-8 forms is to have the appropriate payee information (name, address, tax ID, withholding status, country of residence, etc.) on file to withhold and remit taxes to the IRS on the artist’s behalf. Like the W-9, the W-8 forms don’t need to be filed with the IRS; they must be retained for your records.

If the non-US artist is a resident of a country with a US tax treaty, withholding may not be required, and the W-8 form will show that. If so, you must request Form 8233 from the artist or agency. This form provides more information about the tax treaty and exemption so you know how much to withhold (if any) from the artist’s pay for taxes. You have 5 days to submit Form 8233 to the IRS. The artist cannot be paid until the form has been sent to the IRS. Typically there are withholding thresholds in tax treaties that must be met to forgo withholding. For example, the Canadian tax treaty allows for a reduced withholding as long payments to the performer do not exceed $15k throughout the year. The IRS generally will not accept Form 8233 if there is an income limit in the treaty because the total of payments for the year can not be determined until after the end of the year. If the tax treaty has a withholding threshold, the artist must apply for a Central Withholding Agreement (CWA) via Form 13930 to have reduced amounts withheld from their pay. For example, if the artist is Canadian and is subject to the $15k threshold mentioned previously, Form 13930 would be needed to guarantee a reduced rate. There are a lot of requirements to get this form approved, and it should be submitted at least 45 days before any payments are to be made.

Finally, the non-US artist must have a US-issued tax identification number to complete form 8233, W-8Ben, or W-8IMY. Without work authorization, they will most likely be unable to attain a tax ID number. This is their responsibility before performing in the US.

Withholding

Unlike a US artist, when paying a non-US artist directly or indirectly through an agency, you must withhold 30% of their gross pay for taxes and remit it to the IRS via EFTPS.gov. The gross pay includes reimbursements unless the expenses are reasonable and substantiated by receipts. The gross pay also includes commissions paid to the agency regardless of who they’re paid to. This is extremely important and often overlooked. For example, assume you hire a non-US DJ for $10k, and $2k is the agent’s commission. If the agent asks you to pay them the $2k directly and the remainder directly to the artist, the $10k is subject to a 30% withholding, not just the $8k. When the artist files their US tax return, they will claim a $2k commission deduction, so they’re not taxed on the $10k. However, it’s still your responsibility to withhold based on gross pay, including commissions.

The deadline for remitting these withholdings to the IRS depends on the amounts. Withholdings greater than $2,000 per artist must be deposited within three business days after the end of the “quarter-month.” Quarter-monthly periods end on the 7th, 15th, 22nd, and last day of each month.

The 30% withholding applies to all non-US artists providing services on American soil unless their W-8 and Form 8233 prove they’re residents of a country with a US tax treaty that allows for reduced withholding, and there are no thresholds in the treaty that must be met to forgo withholding. If there is a tax treaty with their home country, you will need to investigate the details of that tax treaty to understand the exemption and whether it allows you to forgo the entire 30% tax withholding. As mentioned above, a withholding exemption will be rare unless the artist has applied for a CWA.

You can obtain a written statement for US agencies representing foreign artists stating they will act as the withholding agent. Remember, this is not guaranteed protection should the IRS investigate the matter. You can provide this to the IRS to show why you did not withhold, but they may or may not accept it.

Forms to File with the IRS for Non-US Artists

Form 1042 must be filed by March 15 of the following year to report the total payments made to your non-US artists and agencies and their respective withholding amounts. A Form 1042-S should also be prepared for every payee and filed with the Form 1042. Form 1042-S shows the amount each artist was paid and their share of withholding. Therefore, you must issue a copy to each artist, so they have the information they need to file their US tax returns and report the taxes paid on their behalf.

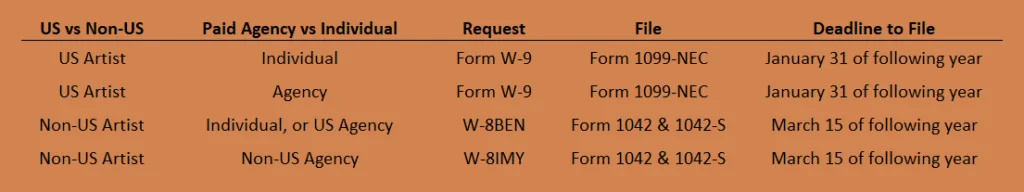

Forms to Request and File When Paying US and Non-US Artists

Here is a summary of what you need to request, and what that information translates into filing for the IRS:

You didn’t get into hospitality and nightlife to spend your time tracking withholdings, payments, and IRS filings for DJs, but this is a necessary evil that could put you out of business if you’re non-compliant. You must ensure that the necessary steps are incorporated into your artist payment and accounting process to ensure compliance with the filings and payments summarized in this article. We understand it’s a lot of work, especially when paying hundreds or thousands of artists annually. Therefore, we have incorporated the above steps into our outsourced accounting and bookkeeping service offering for restaurants, bars, and nightclubs. If we handle your accounting, we also oversee your tax compliance. Feel free to contact us to learn more about our monthly plans.