From a tax perspective, is it more beneficial for restaurants and bars in New York City to set up their tax structure as a partnership or an S-corporation? Restaurateurs have received mixed messages from their CPAs over the years, especially after the Tax Cuts and Jobs Act (TCJA) introduced the Qualified Business Income (QBI) deduction, thus making the S-corporation even less beneficial at certain income levels, as we demonstrate in The Best Tax Classification for Your Restaurant. This blog settles the argument by explaining why NYC restaurants and bars play by a different set of rules and showing you examples of two very practical scenarios and the tax implications of each. With this information, you’ll be able to identify which tax structure will maximize tax savings for your NYC bar or restaurant.

S-corporation vs. Partnership Fundamentals in NYC

A restaurant structured as an LLC can be taxed as an S-corporation or Partnership. The main benefit of partnerships and S-corporations (compared to a C-corporation) is that they don’t pay any tax directly; instead, their taxable income flows to the partners who pay tax on the income on their personal tax returns. In addition, S-corporation profits are not subject to a 15.3% self-employment tax, making them the entity of choice for the last 30 years for restaurants with one class of ownership, less than 100 shareholders, and no foreign shareholders.

However, in NYC, S-corporations have been less popular because NYC requires S-corporations to pay an 8.85% corporate tax on their taxable income, whereas partnerships pay only 4%, aka the unincorporated business tax (UBT). Furthermore, a portion of the UBT can offset NYC taxes paid by partners on their personal tax returns, a benefit not available to S-corporation shareholders. The credit phases out from 100% to 23% for taxpayers with city taxable incomes of more than $42,000 but less than $142,000. For taxpayers with city taxable incomes of $142,000 or more, the credit is 23% of the UBT imposed. No such credit is available for S-corporation shareholders; therefore, restaurant owners need to assess whether the federal self-employment tax savings from having an S-corporation in NYC exceed the double taxation at the city level. It’s frequently more advantageous for NYC restaurants structured as LLCs to file as a partnership instead of an S-corporation, depending on their profit and owner’s compensation for services provided.

Finding the Ideal Tax Structure to Maximize Tax Savings

Even though you’re in NYC, an S-corporation may still be beneficial; it’s essential for your accountant to do an analysis considering all the following before jumping to any generalized conclusions. To maximize tax savings, you must determine:

- Do the self-employment tax savings exceed the net tax savings from paying and deducting the Unincorporated Business Tax (UBT) instead of the General Corporation Tax (GCT) and being able to claim a portion of the UBT as a credit on the owner’s personal tax returns?

- Will the decrease in the QBI deduction due to paying managing members a reasonable salary or guaranteed payments exceed the self-employment and GCT savings?

Tax Savings for Your NYC Bar or Restaurant

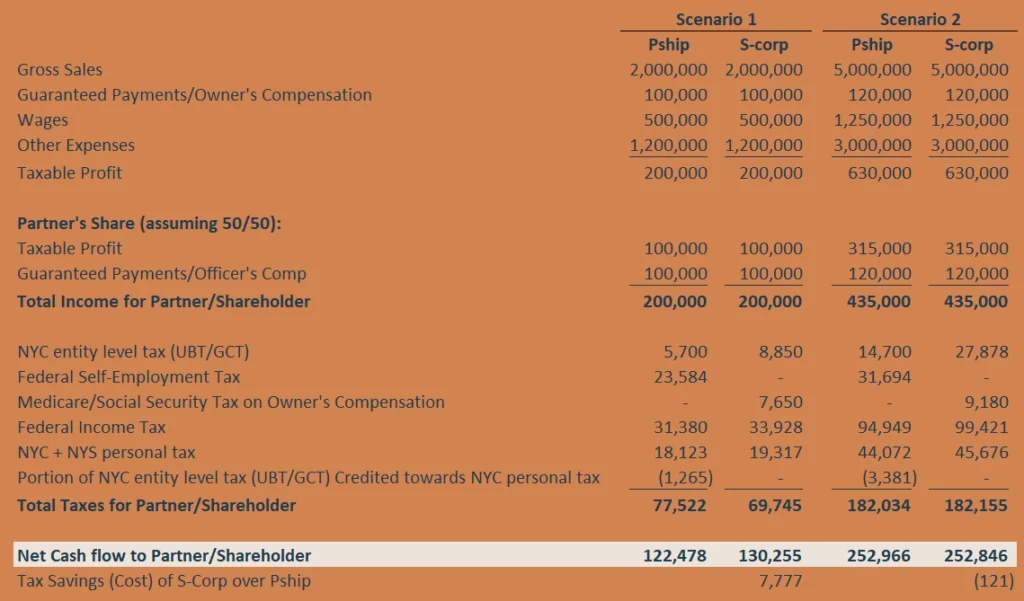

Let’s examine two profitable restaurants to demonstrate the tax burden and cash flow to the 50% managing member The scenarios below assume that they can be taxed as a partnership or S-corporation:

As you can see, at a lower-profit restaurant (scenario 1), an S-corporation tax structure saves the managing member about $8k in taxes, whereas in a higher-profit restaurant (scenario 2), an S-corporation tax structure doesn’t save anything.

No general rule of thumb exists when determining the ideal tax classification for an LLC in NYC. There are a lot of variables, as you have seen above. Working with an accountant who can guide you and explain the most beneficial tax classification for your restaurant or bar is essential. This is so essential that we have incorporated tax entity selection planning into our new client onboarding process. Please reach out if you have any questions or want to learn more about what we do to help hundreds of restaurants and bars succeed.