Every restaurant has controllable and non-controllable expenses. Controllable profit measures the amount left over after deducting controllable expenses from your sales. A seasoned and effective general manager will maximize controllable profit by monitoring and managing the controllable expenses. In this article, you’ll learn how to calculate controllable profit and why it’s an important measure of management’s effectiveness and performance.

Controllable Profit

Controllable expenses are those expenses that can be controlled or influenced by the restaurant management and staff.

Controllable expenses typically include:

-

- Cost of Goods Sold

-

-

- food

- soft beverages

- liquor, beer, wine

- merchandise

-

-

- Labor

-

-

- salaries and wages

- payroll taxes

- employee benefits

-

-

- Direct Operating Expenses

-

-

- uniforms

- laundry/linen

- tableware-glassware

- kitchen utensils

- cleaning supplies

- paper

- bar supplies

- menus/printing

- contract cleaning services

- decorations/-flowers

-

-

- Music and Entertainment

- Marketing

- Utilities

- General and Administrative Expenses

- Cash over/short

- dues and subscriptions

- office supplies

- personnel/recruiting costs

- claims and damages

- professional fees

- Repairs and Maintenance

Non-controllable expenses include expenses that the restaurant management and staff have no control or influence over. These include:

-

- Occupancy Costs

- Rent

- Parking rent

- CAM/Insurance/Real Estate Taxes

- Occupancy Costs

-

- Personal property taxes

- Income Taxes

- Equipment Rental

- Depreciation & Amortization

- Interest Expense

- Management Fees

- Corporate expenses

- Officer’s/owners’ salaries

- Partner’s guaranteed payments

- Office rent

- Corporate telephone and other General and administrative expenses

- Legal and Accounting

You must use the restaurant uniform chart of accounts to distinguish controllable and con-controllable expenses and measure controllable profit accurately and reliably. Separating the controllable from non-controllable makes it possible to calculate one of the more valuable margins on any restaurant’s P&L: Controllable Profit.

Controllable Profit = Sales – Controllable Expenses

Controllable profit can also be measured as a percentage of sales.

Controllable Profit / Sales = Controllable Profit as % of Sales

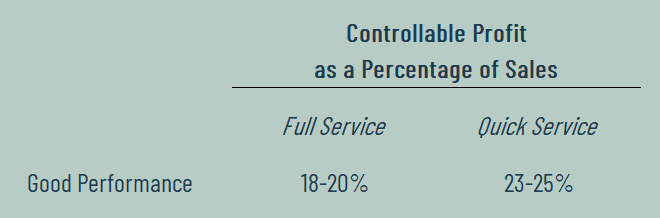

RestaurantOwner.com provides these industry averages as benchmarks for a healthy, controllable profit as a percentage of sales:

Managers and Controllable Profit

Again, controllable profit measures the portion of total profit that management can control or influence. As noted earlier, management can’t control certain fixed costs like occupancy, interest, depreciation, etc. However, sometimes management may earn an incentive or bonus driven by controllable profit because it is typically one of the best indicators (from a financial perspective) of how well management is directing and handling operations. There is usually a direct correlation between management’s proficiency and controllable profit.

As an alternative to controllable profit, using Earnings Before Interest, Tax, and Depreciation (EBITDA) is widely used to design a management bonus plan because it’s more easily accessible, but if your accounting is set up according to restaurant industry standards, you should be able to monitor controllable profit just as easily. Contact us if you want your financials to reflect industry standard reporting used by national chains at the same price as a bookkeeper.

A management incentive plan based on controllable profit typically rewards management when controllable profit as a percentage of sales exceeds a certain percentage of sales. For example, your manager can earn a bonus when controllable profit exceeds 25 percent of gross sales, and the bonus increases as controllable profit hits 28 percent and then 30 percent or higher.

Check out The Ideal Restaurant Management Incentive Plan in 3 Steps to learn more about structuring your managers’ bonus or incentive plan.

The key to evaluating controllable profit is recognizing that management can only do so much. It’s important to remember that if your sales are not high enough for your location or concept for reasons outside management’s control, no amount of cost management will be able to fix your controllable profit. Contact us to understand how to assess whether sales are not high enough for the space that you’re in – or to get help with any other restaurant accounting questions!