In Part 1, we outlined how to assess the viability and value of a new restaurant project using the sales-to-investment ratio. In this article, we walk you through valuing an existing restaurant and how these valuations are determined by thinking like an investor, and describe common pitfalls and factors that could affect a restaurant’s valuation.

Valuing an Existing Restaurant using EBITDA and Book Value

Experienced buyers or investors assess a restaurant’s value based on return on investment (ROI), and ROI is measured based on cash flow. The most common way to value a restaurant is as a multiple of earnings before interest, taxes, and depreciation (EBITDA). This is a simple and accurate measure of cash flow by looking at a profit & loss statement (P&L).

Book Value

The starting point for calculating a restaurant’s value is the book value of its assets. Book value is the net value of everything the restaurant owns and owes. For example, what would be left over if the restaurant closed tomorrow, sold all its furniture, equipment, etc., paid all its vendors, and paid all its debt? That is the book value. This can be negative and frequently is when the restaurant owes vendors and lenders more than it owns in cash, equipment/furniture/intangibles/etc. Here’s a simple example:

Now that you have the book value, in many cases, this is de minimus (too small to matter) unless you have a very valuable liquor license or lease; therefore, many investors don’t consider it; you will add a multiple of EBITDA to get the overall value.

EBITDA Multiple

A multiple of 2-4x EBITDA is typically used when valuing a restaurant. Generally, the smaller the restaurant, the lower the sales, and the more limited the growth opportunities, the lower the multiple will be. Higher multiples are paid for larger businesses with higher sales and significant growth opportunities. These other factors also affect the multiple:

- Intangibles, including brand equity/goodwill, customer lists, reviews, ratings, accolades, etc.

- Cost of financing (high interest rates could mean lower multiples)

- Liquor license terms

- Lease terms

- Commercial or tax Liens not shown on the balance sheet

- Sales trends (guest count patterns over the years, price increases vs. check averages, etc.)

- Market trends (increased or decreased competition)

- The popularity or lack thereof of a particular chef or food concept

- Demographic and neighborhood trends

- Quality of systemization and procedures

EBITDA may also be adjusted if it does not reflect an owner-operator’s salary.

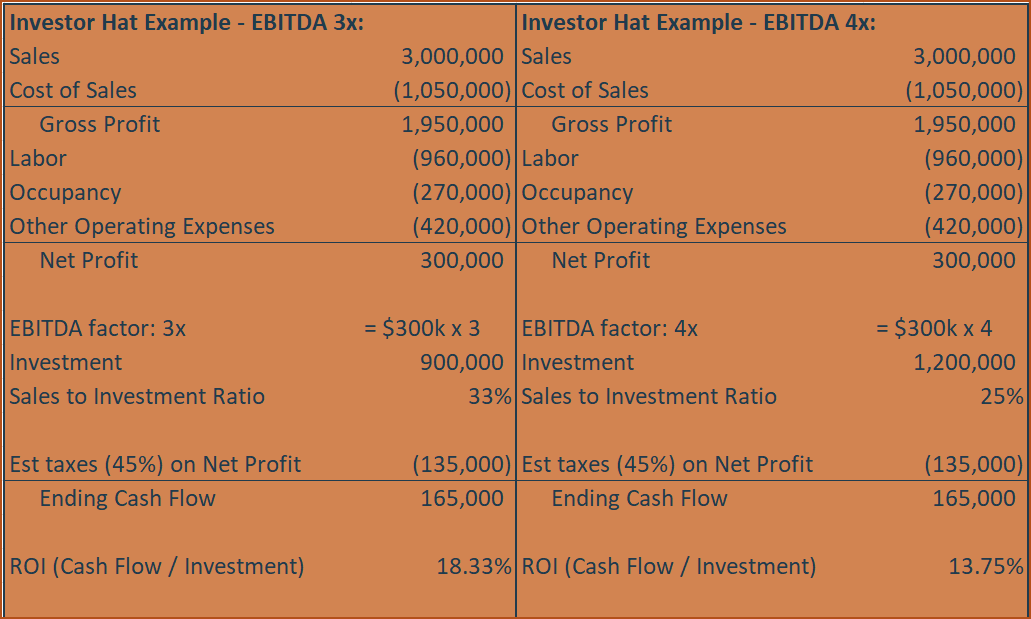

Let’s put our investor hat on and see why 2-4x is an ideal EBITDA multiple for investors. Assume a restaurant generates $3m in sales and $300k in EBITDA. Assuming all the factors above are neutral, a 3x EBITDA valuation would yield a yearly return of 33% ($300k EBITDA / $900k investment) before taxes. The investor would have to pay about $135k in taxes (45% estimated federal and state income tax rate multiplied by $300k EBITDA) on this income, thus giving them a cash flow of $165k. $165k divided by the $900k investment equals an 18.33% return. This is a fair percentage of return that an investor is willing to accept for such a risky investment. If the restaurant is less risky, for instance, it might have a 20-year track record with no expected changes in the market; then the investor might be willing to offer 4x EBITDA. 4x EBITDA using the example above means they would invest $1.2m for the same restaurant and receive $165k in cash flow after taxes each year, which is a 13.75% return ($165k divided by the $1.2m). Offering 4x EBITDA is rare, but it’s still not a bad deal for the investor, especially if they have a complimentary or supplementary business plan for the restaurant. This is how credible investors think. This is how they assess restaurant investments. It helps to think like one when building your restaurant empire.

The Bottom Line of Valuing a Restaurant

Critically value your restaurant or restaurant group like a credible investor, so you know what it takes to build a highly valuable restaurant business. Many restaurateurs will overvalue their “brand” or “intangibles,” thinking that it will mask their profitability issues, but the reality is that if your intangibles aren’t producing profits and cash flow, it doesn’t mean much for an investor or your valuation. If you want to learn more about how The Fork CPAs can help you establish your goals, please schedule a discovery call here or contact us.