Negotiating an ideal lease is the first step to ensuring your restaurant is set up for success. If sales are not high enough for the space that a restaurant is in, no amount of cost management will be able to fix a cash flow or profitability problem that could arise later. In this article, we will show you how to determine the ideal occupancy cost, and what to look for when negotiating the ideal percentage rent for your restaurant.

What is Occupancy Cost?

First, let’s make sure we’re working with the right pieces of information. Occupancy cost includes rent, common area maintenance (CAM) costs, property taxes, insurance (on the building), and real estate taxes. Occupancy cost – for purposes of this discussion – does NOT include expenses like utilities and depreciation.

What is the Ideal Occupancy Cost?

When using occupancy cost to analyze the health of your restaurant, we examine the occupancy cost as a percentage of sales: base rent + percentage rent + CAM + property and real estate taxes + insurance, all divided by sales. Assuming that your other non-occupancy expenses are around industry averages, you’re aiming for an average occupancy cost per sales of 7-9%. Low occupancy cost as a percentage of sales is about 5-6%; high occupancy cost as a percentage of sales is anything over 9%.

Occupancy Cost as a Percentage of Sales Calculation

Let’s walk through an example to get a feel for how we get to these numbers.

Assume that your potential lease agreement calls for a base rent of $5,000 per month plus 9% of sales over $80,000 each month, you got estimated tax figures of $300 per month for property and real estate, and a quote for insurance and CAM for $700 per month. If your restaurant brings in $100,000 in sales each month, your occupancy costs will be 7.8%. Here’s how we got there:

$5,000 Base Rent

+ $1,800 (calculated from ($100,000-$80,000)*9%)

+ $300 RE Taxes

+ $700 CAM and insurance

= $7,800 Occupancy expense per month

Then divide your occupancy expense by your sales ($7,800 / $100,000) to get to 7.8%.

The portion of your rent that is a percentage of sales is important because it puts more risk on the landlord. However, you should make sure that if you don’t break that threshold, your occupancy cost will be manageable.

It’s important to run this calculation using several different projected sales to make sure your occupancy cost won’t get out of your ideal range under reasonable circumstances.

Negotiating the Ideal Percentage Rent for Your Restaurant

Many restaurant owners try to avoid percentage-of-sales rent provisions altogether. However, if negotiated appropriately, a percentage rent clause can shift some risk-of-loss onto the landlord during lean times. You’ll need to identify the sweet spot based on three factors:

-

- Base rent

- Percentage of sales rent rate

- Sales threshold where the percentage of sales rent rate kicks in

The goal is to ensure that the percentage rent never kicks in before the occupancy cost is less than 8% of sales, and that occupancy cost as a percentage of sales never surpasses 8%. This may require you to negotiate a higher percentage rent threshold, at the price of a higher base rent or vice versa depending on the risk involved for the new location.

How to Calculate the Ideal Percentage of Sales Rent

We’re going to walk you through three scenarios with three options each, so you can see the negotiation of percentage rent in action.

Scenario 1

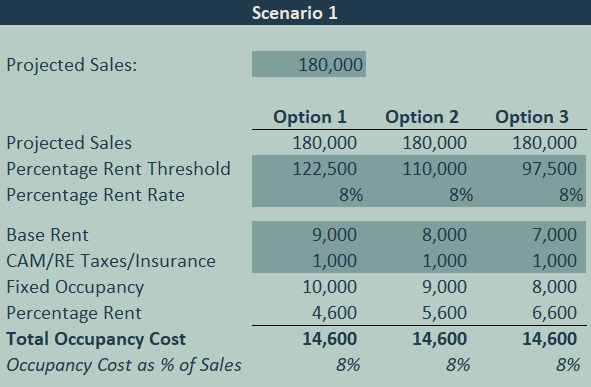

Assume a restaurant is negotiating a lease that contains a percentage rent clause. The restaurant is expecting to generate $180,000/month in sales from this location. The landlord is offering three options:

Option 1:

$9,000/month in base rent, $1,000 to cover CAM and real estate taxes, and 8% of sales once $122,500 in sales is reached.

Option 2:

$8,000/month in base rent, $1,000 to cover CAM and real estate taxes, and 8% of sales once $110,000 in sales threshold is reached.

Option 3:

$7,000/month in base rent, $1,000 to cover CAM and real estate taxes, and 8% of sales once $97,500 in sales is reached.

The obvious choice would be Option 3 in this scenario because the risk is low and occupancy cost as a percentage of sales stays the same (8%) regardless of the sales number under each option.

Scenario 2

In reality, the landlord needs to see some upside in return for lowering the base rent, therefore they might lower the percentage rent threshold or increase the percentage rate as the base rent decreases. In this scenario, we will show the impact of both a percentage rent threshold decrease at the lowest base rent, and an increase at the highest base rent on the occupancy as a percentage of sales. This scenario assumes the sales are still projected to be $180k.

As you can see, option 3 is not looking so good anymore, and gets even worse if the sales are expected to be higher than $180k.

Scenario 3

Let’s assume the same facts as Scenario 2, but with projected sales of $220k.

Now option 1 is looking like the best deal and will only be more favorable as the projected sales increase.

You want to make sure that wherever your projected sales land, that your expected occupancy cost as a percentage of sales is not exceeding 8% of sales. That should be the absolute maximum, ideally you want to aim for 5-7%.

Other Considerations When Determining the Ideal Percentage Rent for Your Restaurant

Once you’ve established that your potential lease puts you in the acceptable (or ideal!) occupancy cost zone, dig into the details that affect how ”sales” are calculated for purposes of the percentage rent calculation. For example, mandatory service charges should not be included in the sales calculation for the lease payment. Percentage rent is typically calculated based on net sales – so including comps and discounts – rather than gross sales. This differs from other benchmarks like prime costs, as discussed here. If you’re making sales anywhere outside of your immediate location, check to see if off-premise sales like third-party delivery and catering are included in the lease payment calculation. You may want to exclude off-premise sales during negotiation.

Utilities in Occupancy Cost

Remember how we said that utilities are not part of occupancy cost, at the very beginning of this article? We specify that because some landlords – particularly food halls and food courts – may include utilities as part of the lease agreement. When calculating occupancy cost for these types of leases, be sure to exclude estimated utilities from your calculation, or allow a little grace for inflated occupancy costs as a percentage of sales. This is because the benchmarks we gave above are industry standards that do NOT include utilities.

Final Word on Occupancy Cost and Lease Negotiation

Most of your lease negotiations will be driven by your projected annual revenue. Do not rush this process. Do everything in your power to accurately estimate the revenue because most of your decisions before opening will be based on this figure. We highly advise trying to find a location and negotiate a lease that will yield no more than 8% occupancy cost as a percentage of sales (ideally 5-7%), rather than counting on beating the industry averages in other cost areas. As always, if you would like to know more about occupancy costs and how your lease is affecting your P&L, schedule a call with us!