A restaurant’s sustainability and growth potential are highly driven by its capitalization and the amount of liquid assets (like cash) that it retains. If a restaurant is not properly capitalized, its operations will be strained, vendors will not extend terms, and it will be unable to take advantage of growth opportunities. If a restaurant is overly capitalized, then it could be sitting on too much cash that is not at work. The goal is to maintain the ideal capital balance so that your suppliers are happy, operations run smoothly, and owner cash achieves the highest return possible. A restaurant has two types of capital: working capital and growth capital. This article demonstrates how to determine your restaurant’s appropriate cash reserves and working capital requirements.

Current Ratio and Quick Ratio

Before you can jump into calculating your cash reserves and working capital requirements, it’s important to understand two sections of your balance sheet: current assets and current liabilities.

Current assets in a restaurant include everything you own that can be quickly converted to cash to cover your expenses or short-term debt obligations. This includes cash, inventory, prepaid expenses, and receivables.

Current liabilities in a restaurant include all obligations that must be repaid or serviced within a year, including sales tax, accrued payroll, event deposits, gift cards, vendor bills, and credit card bills.

The ratio of current assets to current liabilities measures your restaurant’s short-term financial health and liquidity. There are two liquidity ratios: Current Ratio and Quick Ratio.

Current Ratio = Current Assets / Current Liabilities

Quick Ratio = Current Assets – Inventory / Current Liabilities

The current ratio tells you whether your liquid assets (current assets) are sufficient to cover your near-term debt obligations (sales tax payable, vendor bills, credit card debt, etc.). The quick ratio determines whether liquid assets sufficiently cover your near-term debt obligations without considering inventory. The quick ratio provides a more skeptical and conservative view of liquidity because inventory is not always liquid, meaning you may be unable to sell it quickly enough to cover your short-term debt.

If your current or quick ratios are below 1:1, you are at risk of being unable to cover your day-to-day expenses and could go out of business. Restaurants can run leaner than other industries because they are cash-heavy businesses, meaning all customers pay on the spot, so they rarely wait for customer payments (accounts receivable).

The ideal amount of working and growth capital yields a current and quick ratio of at least 1:1!

Determining Your Working Capital Requirements

Now that we know more about liquidity, we can determine the ideal working capital. Working capital measures the assets available to cover your day-to-day operations. It ensures your restaurant can operate smoothly and survive despite the toughest times. It is calculated by subtracting all your short-term obligations (current liabilities) from all your liquid assets (current assets).

Working Capital = Current Assets – Current Liabilities

For this article, we will assume working capital is the cash available to cover your day-to-day operations. If your working capital is insufficient, you’re at risk of being unable to pay your vendors or employees and may need to shut down.

To determine the ideal working capital for your restaurant, follow these steps:

-

- calculate how far below zero your cash flow is at its worst before your cash flow is positive again; then

- add 1% of annual sales for a capital expenditures and repairs budget; then

- add a cushion of 2 weeks of sales. This ensures that you can continue to cover your expenses even when your business is at its lowest.

For most restaurants, this equates to having one month of operating expenses (not including COGS) in cash, unless you are not profitable or seasonal.

Seasonality and historical cash flow typically drive the calculation!

If your business model is extremely seasonal (beer garden, beach bar, ski town restaurant, etc.) or not profitable, the formula above will yield a much higher working capital requirement. Although every restaurant is somewhat seasonal, most are not. You should always pick what you’re comfortable with based on your model. For example, successful restaurants in DC and NYC in non-touristy neighborhoods are frequently profitable most of the year except in the summer when most people leave the city for vacation. Therefore, we recommend keeping their projected summer deficit in a reserve account, plus a cushion of 2-3 weeks of sales, plus a repairs and capital improvements budget. For beer gardens in DC and NYC, it’s just the opposite. They need to retain their winter deficit in a reserve account.

Managing Capital in a Restaurant

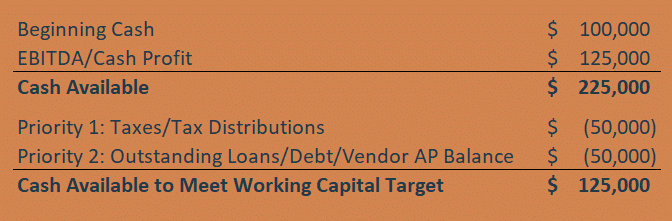

Here is the order in which you should manage your cash to ensure you have the proper amount of working capital:

Priority 1 is to issue tax distributions so shareholders/partners can pay their taxes or pay the taxes directly in the case of a state with entity-level corporate taxes.

You only take a profit distribution or reinvest cash when all your taxes/tax distributions have been paid, and you have money above your working capital target.

You must go through this period of accumulating working capital to have the cash resources to react to opportunities coming your way. If you have debt, you won’t be able to pursue any of these opportunities. Cash always wins!

Growth Capital & Distributions

All cash you accumulate beyond your working capital target becomes your growth capital. It can be reinvested to grow and expand your restaurant concept as it accumulates. If you are not trying to expand, then growth capital can be distributed to owners or reinvested in other assets such as real estate, stocks, bonds, money market accounts, savings accounts, a beach house, etc. Your long-term debt obligations should be considered before distributing or reinvesting your growth capital.

Monitor Your Working Capital and Liquidity

Maintaining the proper amount of working capital is extremely important for the health of your restaurant. You must always be capitalized to hire your ideal employees, pay your ideal vendors, and maintain and sustain your ideal ambiance. Once properly capitalized, you can determine whether any excess capital will be distributed to shareholders or reinvested in your growth.

Profitability is extremely important when trying to get properly capitalized. If you’re not profitable, your working capital requirements are even higher and must come from somewhere. A non-profitable restaurant may borrow money or do another capital call to meet its working capital requirements. However, borrowing or raising additional cash only exacerbates the issue and is only a band-aid for the real profitability issue.

You need an accurate balance sheet to assess your liquidity and whether you are properly capitalized. Unfortunately, many restaurateurs skip over the balance sheet and only focus on the Profit and Loss (P&L) statement. With an accurate and timely balance sheet and solid reporting software, you should be able to monitor these ratios in real time. If you’re not getting access to your working capital and current ratios every week, don’t hesitate to get in touch with us, and we can make this happen!