How much does restaurant accounting cost? How much should you be paying? The short answer is it depends. In this article, I will explain the dependencies that significantly influence the cost of restaurant accounting.

Before we dive in, let’s understand the purpose of restaurant accounting and the options that are out there. The purpose of restaurant accounting is to:

- provide management and owners with insight into performance;

- stay compliant by filing accurate and timely taxes;

- avoid theft and catch errors;

- ensure that vendors are paid and

- all payments are received

As outlined in our Why You Should Outsource Your Restaurant’s Accounting article, there are multiple options for achieving this:

- hire a bookkeeper throughout the year, plus a CPA at the end of the year for the taxes

- hire a CPA firm that provides outsourced accounting to do accounting throughout the year and file taxes at the end of the year

- leverage the accounting department of an existing restaurant group to provide all of the services for you

- hire a family member or spouse who is a talented bookkeeper or accountant

The option you select will affect the pricing, but it shouldn’t change the ideal price. To understand what you need to pay, you will need to understand the cost drivers for accountants so you’re not confused about the wide range of pricing when considering your options.

Volume & Scope

The cost for restaurant accounting is typically driven by volume. A restaurant grossing $700k in revenue should theoretically have fewer bills, employees, and bank/credit card transactions than a restaurant grossing $3M in revenue, increasing the amount of work performed and the cost. However, volume and revenue also affect the scope of work. A restaurant with $3M+ in revenue should delegate more to an accountant than a restaurant with $700k. A service that a $3M+ restaurant should delegate that a $700k+ restaurant probably will not is bill pay and vendor reconciliations because the management of the larger restaurant will not have the time to do this accurately and timely. On the other hand, a restaurant with $700K in sales can probably do this in-house, and any errors missed will still be less costly than delegating this to an accountant.

Therefore, anytime you get a quote from a restaurant accountant, it will typically be driven by revenue. An experienced restaurant accountant should be able to understand exactly how much work is required as measured by your revenue, so this is a good way to gauge whether the accountant knows what they are doing. At our firm (and many other firms), we will ask more questions and look at your existing books to understand if there are any nuances beyond the revenue that could affect the price. Here are some of the nuances beyond volume that could affect the price you pay for accounting:

- Multiple units being run through the same books

- Multiple POS systems or revenue centers being run through the same books

- Third-party delivery sales are not being rung up through the POS

- Notes or loans on the books

- An unprecedented amount of bank accounts and credit cards

- Affiliate company transactions being run through the business account that require intercompany reconciliations

- Co-mingling personal expenses

- # of vendors

- # of third-party delivery systems

All of these factors will increase the complexity of your financials and thus increase the accounting cost.

Quality & Accuracy

Gauging the quality and accuracy of your restaurant’s financials is difficult when you are not an accountant, but it’s very important because it’s the second-most impactful driver of price in restaurant accounting after volume. Many accountants provide value-based pricing: “Pay us whatever you can, and we will adjust our services to cater to your budget.” Two different accountants can provide you with identical lists of services they will provide, yet the results for those services could be completely different. Let’s look at some services and how they can differ between accountants.

Here’s a service item from one of our monthly plans: Record and Reconcile Sales with POS. There are many corners that an accountant can cut to provide effectively these same service items for half of the price so they still stay profitable. For example, they could record gift card sales as revenue when the payment hits the bank instead of accurately recording the liability and recognizing it when it’s redeemed. Another example of cutting corners related to this service item is recording sales and sales tax as revenue when the deposit hits the bank account instead of appropriately making a sales entry to recognize revenue on the day it is earned and the sales tax liability on the day it is incurred.

Our service item list is pretty specific, so here’s an example of accountants offering a more common service item: Reconcile Bank and Credit Card Transactions. This could mean a thousand different things, and many accountants like that because it gives them flexibility in delivering scope (aka the ability to cut corners). Some of the tactics an accountant can use to cut corners for this service item are:

- Running third-party delivery sales through a clearing account and closing out the balance each month to the P&L rather than reconciling the third-party sales with the POS daily.

- Running credit card deposits through a clearing account instead of reconciling each day’s sales with the deposits

- Skipping daily cash deposit reconciliations with cash to be deposited per the POS

- Recording transactions on a cash basis vs. accrual basis or a hybrid rather than full-accrual basis

- And the list goes on….

Another service item that an accountant could easily cut corners on is bill pay. Here are two scenarios to consider:

Accountant 1:

- Requests statements from vendors based on the terms for each vendor and the due dates of the bills

- Creates dummy or placeholder bills in the accounting system for all bills that are missing or not uploaded by the restaurant

- Trues up the balances for bills uploaded by the restaurant that have different values from the vendor records

- Pays the balance of the statements, records the payment in the accounting system, and matches the payment with the bills.

Accountant 2:

- Requests statements from vendors based on the terms for each vendor and the due dates of the bills

- For each missing bill that is not uploaded from the restaurant, the accountant requests a copy of the bill from the vendor or restaurant that is signed by the receiver at the restaurant

- Vendor credit is requested for any discrepancies between the vendor records and the bill uploaded by the restaurant. If the vendor doesn’t agree with the credit, the issue is escalated to restaurant management.

- The signed copies of the missing bills and the vendor credits are recorded in the accounting system.

- A new statement is requested from the vendor reflecting the credits and other updates

- Pays the balance of the statements, records the payment in the accounting system, and matches the payment with the bills.

Which accountant provides a larger net benefit? Guess which accountant charges more? The answer to both questions is Accountant 2 because the amount of money they save the restaurant each month by not cutting corners on statement reconciliations is in the thousands of dollars. This amount varies depending on the volume and size of the restaurant.

Here is a more general list of questions you can ask when presented with a “too good to be true” price:

- Will the books be prepared on a full accrual basis or a cash basis? Or a hybrid? If a hybrid, then which component will be on a cash basis and why?

- What is your process for recording and reconciling sales?

- How will the credit card tenders, cash tenders, and third-party delivery sales be reconciled?

- How will the payroll be recorded?

- Will you do end-of-month payroll accruals (if reporting every month instead of 4-week periods)?

- Will you be recording inventory? If so, how often?

- If paying the bills, will you simply be paying whatever you are presented with, or will you be reconciling the bills as received by the restaurant with the vendor’s request?

- How frequently are the books reconciled?

To understand which “corners are being cut,” you must request a detailed engagement letter and scope of work that outlines every single service item that the accountant will be provided along with a detailed description of how and when they will execute each service item; do not leave room for interpretation.

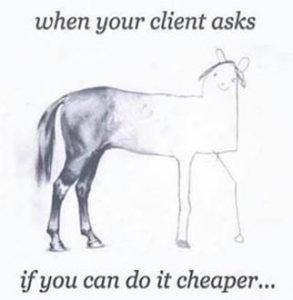

To sum it up, if two accountants are more or less equal in competence and experience, and one is charging drastically less, then there is a high chance that they are cutting corners. Ask yourself, “Is the price reduction worth the cutting of the corners?” The answer could be yes; it depends on which corners are being cut for each service item and whether these are important to your business. If you only sell one gift card monthly, paying double for the service item that records and reconciles gift cards may not be worth it. But if 20% of your sales are from third-party delivery systems, paying the premium to ensure these sales are reconciled is well worth it because you know that the third-party delivery sales are being captured correctly and errors are being caught.

While assessing price vs. competence, it’s important to remember that an incompetent accountant can lead to theft, fraud, and/or missed tax or payroll filings with compounding interest and penalties that could put you out of business.

The Right Fit

With accounting, you typically get what you pay for unless the accountant is not a good fit.

First, size matters, so do not let a big firm do a small firm’s job. For example, if you are a single-unit restaurant grossing $1m in revenue per year, you probably should not engage a big four accounting firm to do your accounting and taxes. There is a sweet spot where paying more has diminishing returns, and you are essentially just paying more because you are not a good fit.

Second, the accountant should be a subject matter expert or specialist in restaurants. They might be the best accountants in the world and can figure out how to do restaurant accounting, but guess who is paying for the time it takes them to learn how to do it? You! This goes back to the point of diminishing returns; just because you are paying more doesn’t mean you’re necessarily getting a better service because a portion of that premium is being attributed to a learning curve. Also, a restaurant subject-matter expert will ensure:

- You can access all the essential KPIs for assessing a restaurant’s performance (food, labor, occupancy, etc.)

- Red flags specific to restaurants are detected and brought to your attention

- Industry best practices are implemented

- You’re in the loop about tax updates and incentives available to restaurants

The sweet spot is finding a competent accountant who specializes in restaurants so they can provide a reliable and accurate service at a fair price point.

How much should you pay?

With that said, how much should you pay for restaurant accounting? The amount you pay should be based on cost/benefit. Revenue is the best indicator of whether the accounting cost is worth the benefit. After all, paying $500 extra per month for vendor reconciliations that will save you $200 is not worth it unless it saves you $800 worth of time. I have developed this chart to show you how much you should pay at each revenue tier to get the right balance between cost and benefit.

| Revenue | Monthly Price |

| <$1,000,000 | $700 – $1700 |

| $1,000,000 – $2,000,000 | $1700 – $2100 |

| $2,000,000 – $3,000,000 | $2100 – $2300 |

| $3,000,000 – $4,000,000 | $2300 – $2500 |

| $4,000,000 – $5,000,000 | $2500- $3400 |

| $5,000,000 – $7,500,000 | $3400 – $4000 |

| $7,500,000 – $10,000,000 | $4000 – $6000 |

| $10,000,000+ | $6000+ |

Accounting is a service that scales, meaning if you provide the same level of service at $1.5M in revenue and $500K in revenue, then the accounting price should not change much. However, the accounting for a restaurant with $1.5M in revenue should not receive the same level of attention as a restaurant with $500K in revenue. The table above considers the level of services that an accountant should provide to a restaurant at each revenue level. For example, in the $1M+ revenue range, a restaurant should start outsourcing their bill pay. A restaurant with less than $500K does not need to record daily sales entries because the accounting cost would exceed any benefit you receive from this service item.

Conclusion

There it is; the amount you pay for restaurant accounting and tax services varies depending on various factors, but it is ultimately a question of how much benefit you receive from the investment and whether that investment is worth it. We have done that analysis based on your revenue and presented the results in the table above. If you pay significantly less than the pricing in the table above, your accountant could be cutting corners or simply not responding to your requests. If you pay significantly more than the pricing in the table above, your accountant may not be the right fit. If you are in the range of the pricing above, and you are confident in the accuracy of your financials, then you hit the nail on the head. Feel free to use this information to help you analyze your current accounting arrangement, and do not hesitate to contact us if you would like our help to get you to the sweet spot!

Article by Raffi Yousefian, CEO | Published 07/13/2021, updated 12/18/2024