Outsourced accounting for

restaurant groups who want an

operation that runs itself (without

hiring an in-house finance team).

Grow your Empire.

Grow your Wealth.

Our back-office support is designed for

independently owned restaurant groups who:

Get the data you need to keep

investors confident

Flying blind will only get you so far. To grow a restaurant group that’s scalable, sellable, and providing you with the financial return you’d hoped for, you need trustworthy numbers. More than just compliance, you want detailed financial insights to know you’re providing the right strategy to your leadership team.

What detailed insights look like:

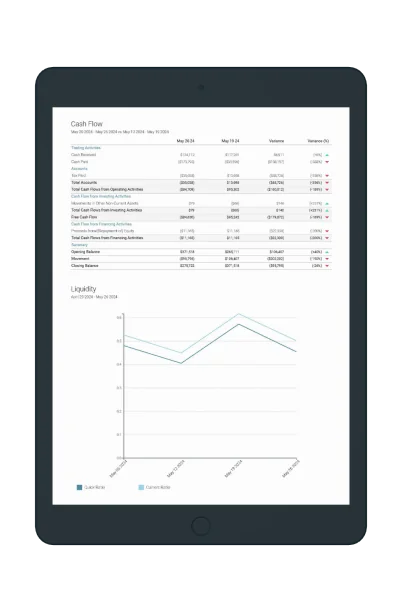

A weekly summary of your cash flow, working capital, vendor payables/purchases, and liquidity.

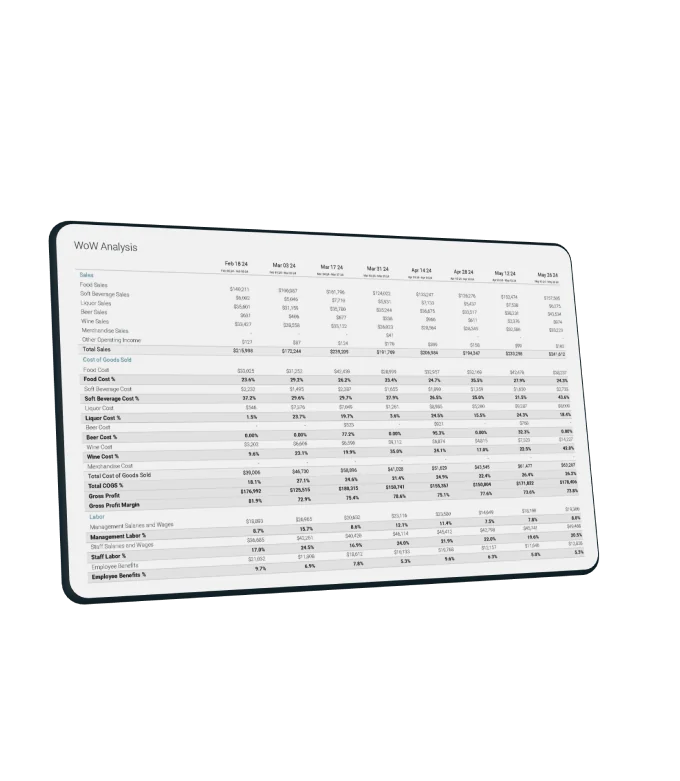

A detailed summary of your performance for the last 13 periods or last 12 months.

A report focusing on two major expense categories: your cost of goods sold (COGS) and labor costs. These costs are combined to form the ‘prime cost’ – a critical metric for understanding your operational efficiency and profitability.

What You Get

Services

Support

Technology

Add-Ons

HOW MUCH DOES IT COST?

Get industry gold standard reporting at a fraction of the cost of hiring an in house team.

We’ll guide you on exactly what you need from our list of services and provide you with a price unique to your requirements. It means you’ll get all the benefits of an in-house team without unnecessary add-ons or costly disadvantages. Even better, our prices adjust as you grow, so you benefit from economies of scale.

IN-HOUSE VS OUTSOURCED ACCOUNTING TEAM

| Revenue | $70M | $50M | $30M | $10M |

|---|---|---|---|---|

| Internal Staff | 1 controller 7 accountants |

1 controller 5 accountants |

1 controller 3 accountants |

1 controller 1 accountant |

| Annual Salaries | $615K | $465K | $315K | $165K |

| Payroll Taxes (7.65% + 3% Fringe) |

$65K | $49K | $33K | $17K |

| Total Cost In House* | $680K | $514K | $348K | $182K |

| OUTSOURCE COST** WITH THE FORK CPAs |

$470K | $384K | $259K | $96K |

| Cost Savings | $210K | $130K | $89K | $86K |

*The cost estimate provided is based on average industry pricing.

**The cost estimate provided is based on average amounts paid by The Fork CPAs’ clients in the corresponding revenue ranges. The actual prices will vary based on a variety of factors that are determined via a discovery call.

TESTIMONIALS

WE PROVIDE STRATEGIC

BACKUP FOR YOUR CFO

Want to be the next hot thing and

create real wealth doing it? The answer

isn’t to get another bookkeeper on

the payroll. Spend your time opening more

stores and providing a quality

experience instead of finding, hiring,

and training an in-house finance team.

Ask a CPA

The most common questions we get asked by restaurant group leadership teams and CFOs:

FOLLOW US ON

INSTAGRAM @FORKCPAS